georgia property tax exemptions for veterans

Surviving spouses and minor children of eligible veterans may also apply for this benefit. To qualify for the exemption the veteran must own the property and must have a 100 Permanent and Total PT VA disability rating OR have been awarded Special Monthly Compensation by VA for 1 The loss or loss of use of one or more limbs or 2 Total blindness in one or both eyes.

If the exemption is granted it entitles you to.

. Qualifying Georgia state veterans are eligible for an exemption from any occupation tax administrative fee or regulatory fee imposed by local governments for peddling conducting a business or practicing a profession or semi-profession. You have market value and assessed value. Any qualifying disabled veteran may be granted an exemption of 50000 plus an additional sum from paying property taxes for county municipal and school purposes.

Unclaimed Property X About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences. Common exemptions include Veteran Disabled Veteran Homestead Over 65 and more. If you or your loved one is a veteran you may qualify for a partial or full property tax exemption.

Call us now at 678-252-9477 to explore the Active Adult lifestyle in Georgia. Here are some important things to remember about property tax exemptions. Discharged under honorable conditions.

To be granted a property tax exemption in Georgia you have to be the owner of the property from January 1 of that taxable year. Georgia offers a homestead property tax exemption for. Property Tax Exemptions for Veterans.

A property may be eligible for exemption in a few different ways including based on the existence of a homestead whether its used as a place of worship and whether its owned by a veteran. You may be required to renew your exemption benefits annually. The exception 85645 would be subtracted from the 40000.

The value of the property in excess of this exemption remains taxable. The 2020 Basic Homestead Exemption is worth 27360. A property tax exemption is the elimination of some or all of the property taxes you owe.

There are several property tax exemptions in Georgia and most are pointed towards senior citizens and service members. 100 disabled veterans those getting VA disability for loss of vision or limbs and their surviving unremarried spouses may be exempt from property tax on their homes. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your Georgia homes value may be exempt from the school tax.

12500000 is subtracted from your assessed value before your bill is calculated. MV-30 Georgia Veterans Affidavit for Relief of State and Local Title Ad Valorem Tax Feespdf 30222 KB Department of. Secretary of Veterans Affairs.

Mitchell Scoggins and Matthew Gambill announced Thursday that the. Veterans Exemption - 100896 For tax year 2021 Citizen resident of Georgia spouse of a member of the armed forces of the US which member has been killed in any war or armed conflict in which the armed forces of the US. The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs.

A reduction of 60000 on the assessed value of your home 40 of its market value in most counties An additional sum determined by the county of residence and dependent on your disability grade and circumstances The maximum exemption is currently 85645 and this figure is revised every year. This exemption requires the veteran to meet all of the following. There is a 1250000 exemption for the County portion of the tax bill.

Not all veterans or homeowners qualify for these exemptions. Are there income tax benefits for Georgia veterans. There are no age or income requirements.

Georgia Homestead Tax Exemption for Disabled Veteran Surviving Spouse or Minor Children. Yes 100 percent permanently and totally PT disabled veterans receive a property tax exemption in Georgia up to 150364 which reduces the taxable value of a veterans home. Paying your property taxes is no easy feat.

The maximum exemption which. The exemption is subtracted from the assessed value. The 2016 Census reports 18285 square miles of land.

Georgia Tax Center Help Individual Income Taxes Register New Business. A disabled veteran who owns a home and meets certain disability criteria is exempt from paying the homestead taxup to 63780. Own your home and reside in it on January 1 of the year in which you apply for the exemption.

Up to 25 cash back If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Homeowners must apply between January 1st and April 1st. In addition if the veteran passes away their surviving spouse or children may also receive the same tax break as long as they continue to reside in the same county.

Exemptions can vary by county and state. Up to 2000 of assessed value of the property for state and school purposes and up to 5000 of assessed value of the property for county purposes. The Local Homestead Exemption is available to all homeowners 65 and older with a net income of less than 1000000.

Under the measure a veterans first 17500 in retirement pay would be exempt from Georgias state income tax which has a top rate of 575. A Rundown on Veterans Property Tax Exemptions by State. Another 17500 of retirement pay would be exempt for.

Exemptions may vary based on which county the veteran resides. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. Kemp signed legislation providing the first military retirement income tax exemption in Georgia history.

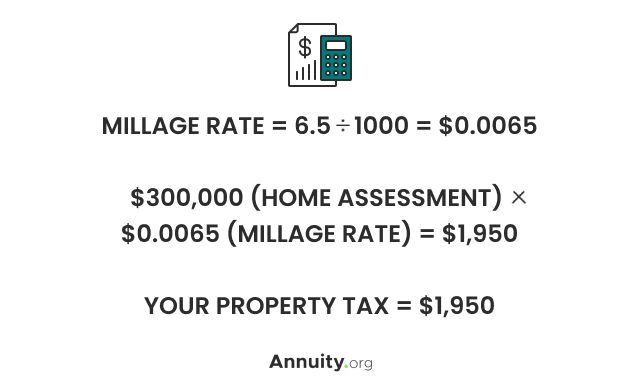

Our breakdown of veterans property tax. The state taxes the assessed value which is equal to 40 of the market value. The amount is 93356 during FY 2022 per 38 USC.

He also signed bills to expedite the issuance of professional and business licenses to military spouses and allow veterans to use their Veterans Health Identification Card when they seek the service of a public notary. Unless you live in states with low property taxes such as Alabama Hawaii and West Virginia you may need help covering your tax bills.

What Is A Homestead Exemption And How Does It Work Lendingtree

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

/PropertyTaxExemptions-5abfea720b6f4b048a2e654e286d7230.jpeg)

Property Tax Exemptions For Veterans

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

Veteran Tax Exemptions By State

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

The Ultimate Guide To North Carolina Property Taxes

City Of Milton Sends Out Annual Property Tax Bills News Milton Ga

Property Taxes Calculating State Differences How To Pay

Property Taxes By State In 2022 A Complete Rundown

Deadline To Apply For Property Tax Homestead Exemptions Is April 1st News Milton Ga

Veteran Tax Exemptions By State

States With Property Tax Exemptions For Veterans R Veterans

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

17 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider